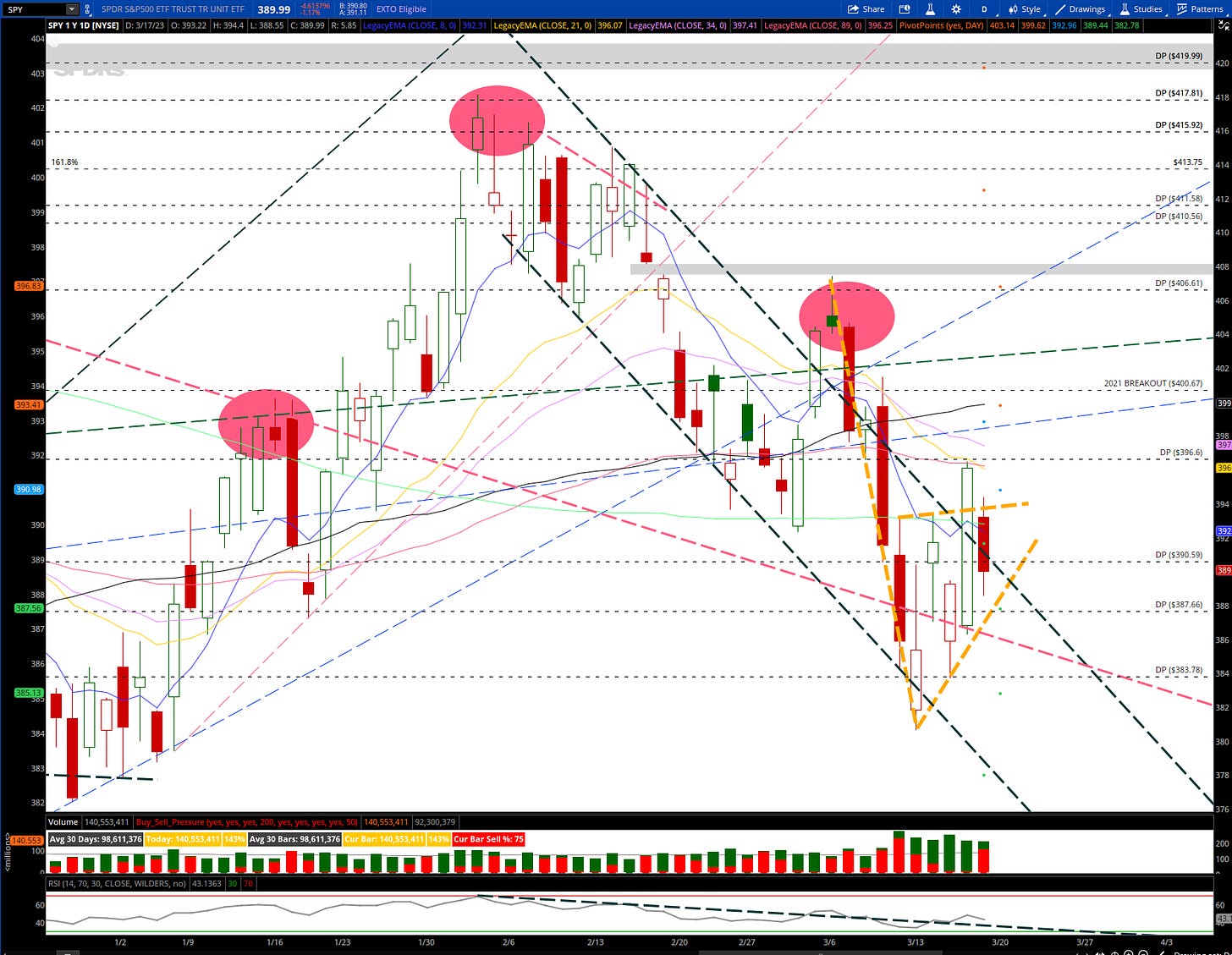

Last week we discovered early on of the large dark pool buys that took place on $385.90. Since then, that level offered tremendous support for the market, leading to a rally back to 396.60 orderflow level before a rejection back into the bear flag. There was later another dark pool buy recorded at 389.15 and this level supported the session on Friday.

Some key levels to watch out for:

- 8ema at 392.31

- 200sma at 392.80

- dark pool buys 385.90, 389.15

- dark pool sells 391.61, 394.10, 396.60

For dark pool transactions.. think of them as large behind the scenes buyers/sellers who can move the markets, and if they are under pressure and what happens if their entry level is breached. For example.. we know Buffet OXY 0.00%↑ level is $55. What happens everytime it gets there? How low can it go before he feels uncomfortable?

Interestingly enough, we have to consider that we have had every excuse to sell below 3900 and we have struggled to stay below it. This is with bank failures, bad data, hawkish fed, you name it. Some of the flow has been mixed. There was extreme bearish flow for March 24th to keep in mind, however this is something we also saw in the past with the FEB 21 strike, and while initially it did sell nicely, by the time we approached opex, those were worthless.

Despite the pullback on SPY 0.00%↑, Crypto saw the opposite, with $BTC reaching higher levels not seen in 9 months. This seemed to be fueled at least initially by the bank failure of SVB. We saw similar rallies in GLD 0.00%↑ GDX 0.00%↑ NEM 0.00%↑ SLV 0.00%↑ etc.

For the week ahead here is what I am watching:

Keep reading with a 7-day free trial

Subscribe to JR28 TRADING SUBSTACK to keep reading this post and get 7 days of free access to the full post archives.