I opened up last week’s newsletter to the public which can be read here:

“The most important thing for me next week will be to watch that prior dark pool sell area at 406.61-407.22. If we reject hard at that level, then 383.78-387.66 is still on the cards for March” (from March 6 weekly newsletter)

On Friday we saw exactly that happen, with SPY running into that 383.78-387.66 area, now what?

Friday’s sell was a considerably high volume and we managed to close BELOW the bear market trendline.

You can see the head & shoulders on SPY 0.00%↑ here clearly laid out:

As you can see we are at the neckline + the neckline just so happens to be at the bear market trendline.

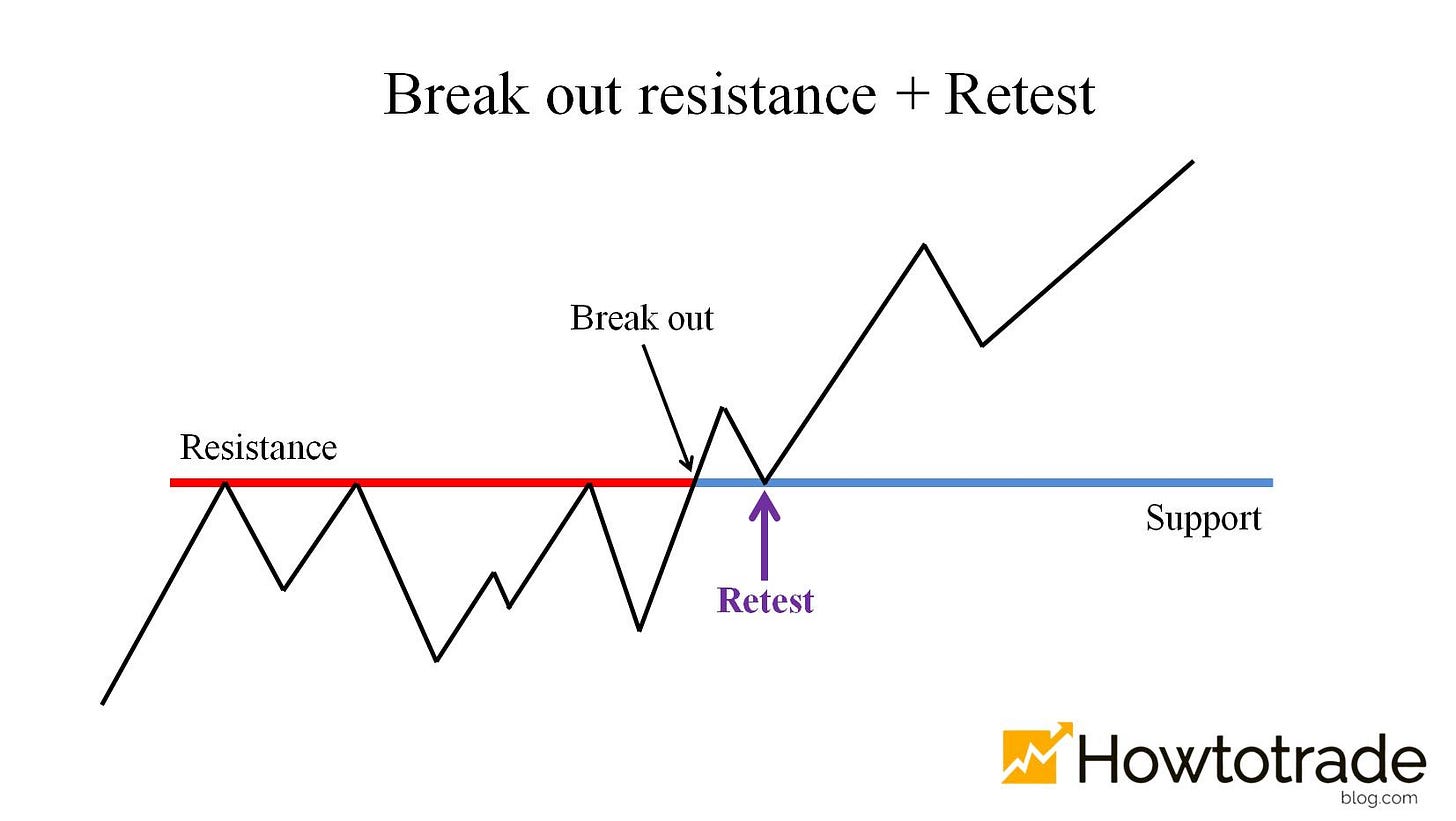

What we had = a breakout from a downtrend to the upside, which is now retesting that prior downtrendline to either confirm the breakout, or reject it (trap):

The 2 possible scenarios now over next couple of months:

1. Failed breakout:

→ IF we break this bear market line down, then this was all an epic bull trap / suckers rally and we are headed to 372 for the measured move of the H&S

Example:

2. Confirmed breakout (retested and held):

→ IF we bounce here, then we confirmed the breakout as a bullish move, and we are headed to SPY 428.32 - 439.90, or ES 4300-4500 (yes, as crazy as that sounds, that's technically, what happens if we broke out of a bear market trendline, and then retested it and held).

Example:

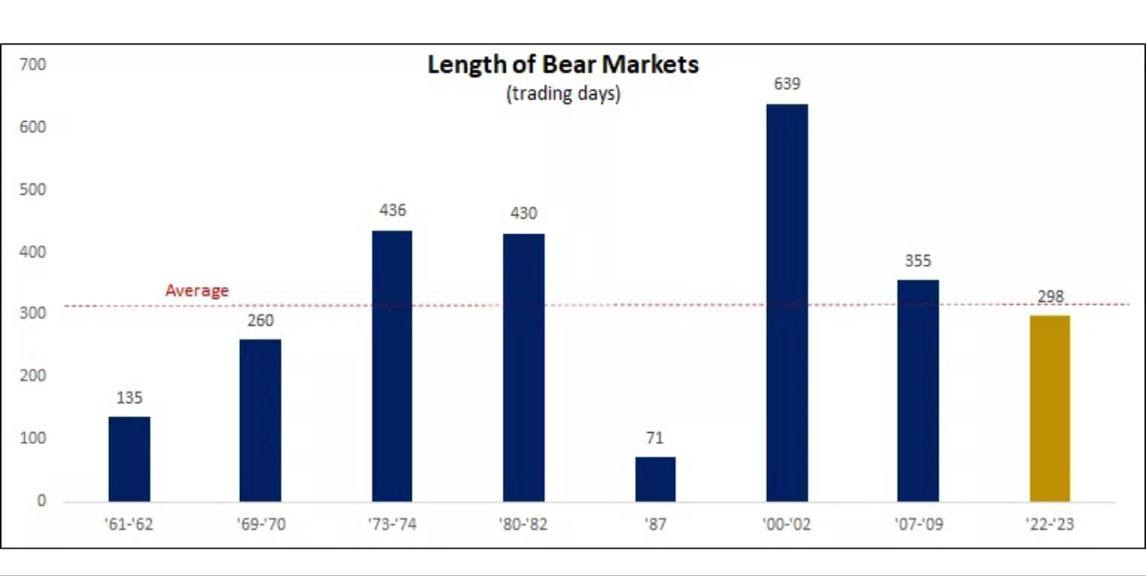

Keeping those in mind, we are at a decision point here going into next week. This bear market is approaching the average length, although these are extraordinary conditions and circumstances in the market currently.

I’m keeping my eyes on TLT 0.00%↑ and Gold which appear close to bottoming.

Reality is that SPY 0.00%↑ has been trading sideways for over 10 months now. This remains a trader's market. We managed several closes over the 200SMA which in the past has marked the end of a bear market, however, we had 2 closes below the 200SMA again last week which confirms this is far from over at this point. If there were to be a dead cat bounce, it is now, as it will be the bull's last stand to keep the breakout in tact. SPY 0.00%↑ put flow into MAR 24 has been relentless, as has APR, MAY, and JUN expiries.

From here we will keep our eyes on the following:

Keep reading with a 7-day free trial

Subscribe to JR28 TRADING SUBSTACK to keep reading this post and get 7 days of free access to the full post archives.