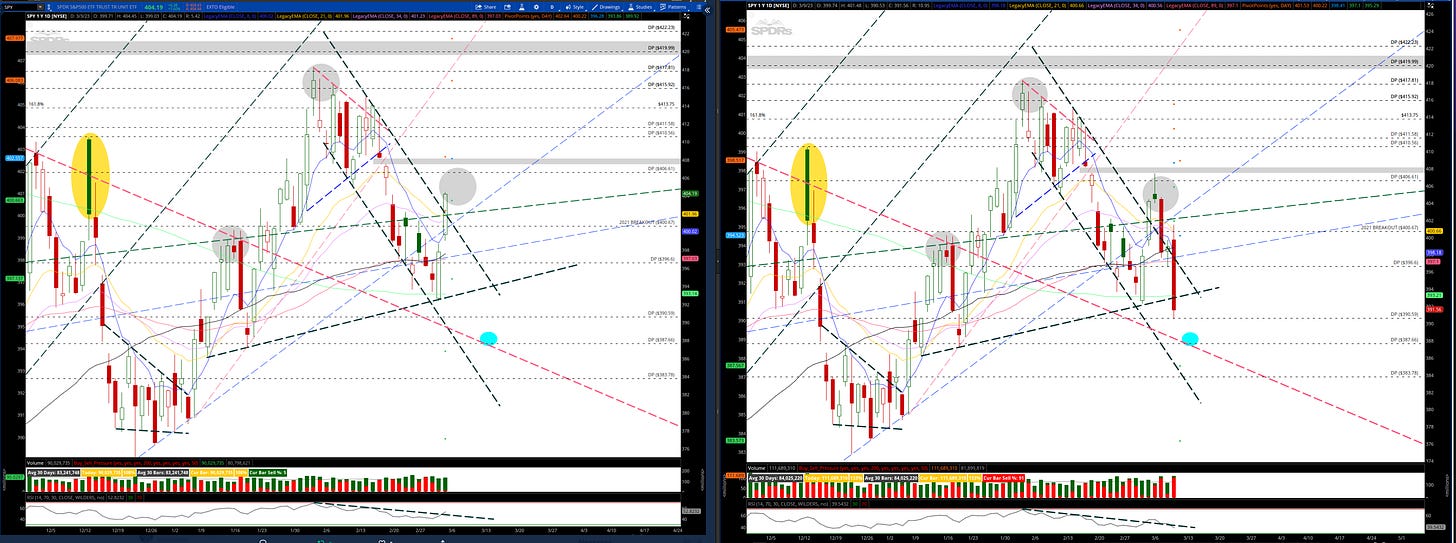

Been mentioning for over a week now that any rebound attempt on SPY 0.00%↑ initially would likely be capped at 407.22, the dark pool seller level we had identified previously. Sure enough we saw a massive rebound from 392 to 407 before a complete 180 back to 390.

Here is the before and after:

Now that you can see that head & shoulders pattern clearly, you can see we closed right around the neckline, and how close we are to retesting that bear market trendline below around 387.66.

One thing i’ve continued to notice is endless bearish put sweeps for March 24th. We noticed those sweeps constantly, even on all the green days and even this morning.

We also noticed the bear flag on SPY 0.00%↑ & ES_F this morning and sent out the alert on discord

On the weekly newsletter I mentioned the importance of ES 4024, and how if we continued to trade below this level then 3984-3914 is likely. We traded as low as 3906 today before a small bounce back to 3930.

”it is likely that sellers will re-emerge as we approach the 4100 area for a trip back down to 3940, and deeper to 3894.”

We also got some great shorts on TSLA 0.00%↑ , AAPL 0.00%↑ , NVDA 0.00%↑

For the next immediate steps i’ll be watching the following:

Keep reading with a 7-day free trial

Subscribe to JR28 TRADING SUBSTACK to keep reading this post and get 7 days of free access to the full post archives.